Financial Well-Being High in Switzerland

The financial well-being of the majority of Swiss residents is high. However, gender differences and dependencies on factors such as education and income are apparent. A recent ZHAW study confirms that Switzerland is a nation of savers and personal finance remains a taboo subject.

Income, wealth, and the proportion of savers have all risen in Switzerland in recent years. Objectively speaking, therefore, households in Switzerland are doing well. According to a representative ZHAW study, three-quarters of those living in the alpine nation also feel comfortable with their financial situation. Researchers at the ZHAW School of Management and Law (SML) looked at the subjective view of financial well-being and surveyed around 1,050 people in German-speaking Switzerland in spring 2023.

Financial well-being is high

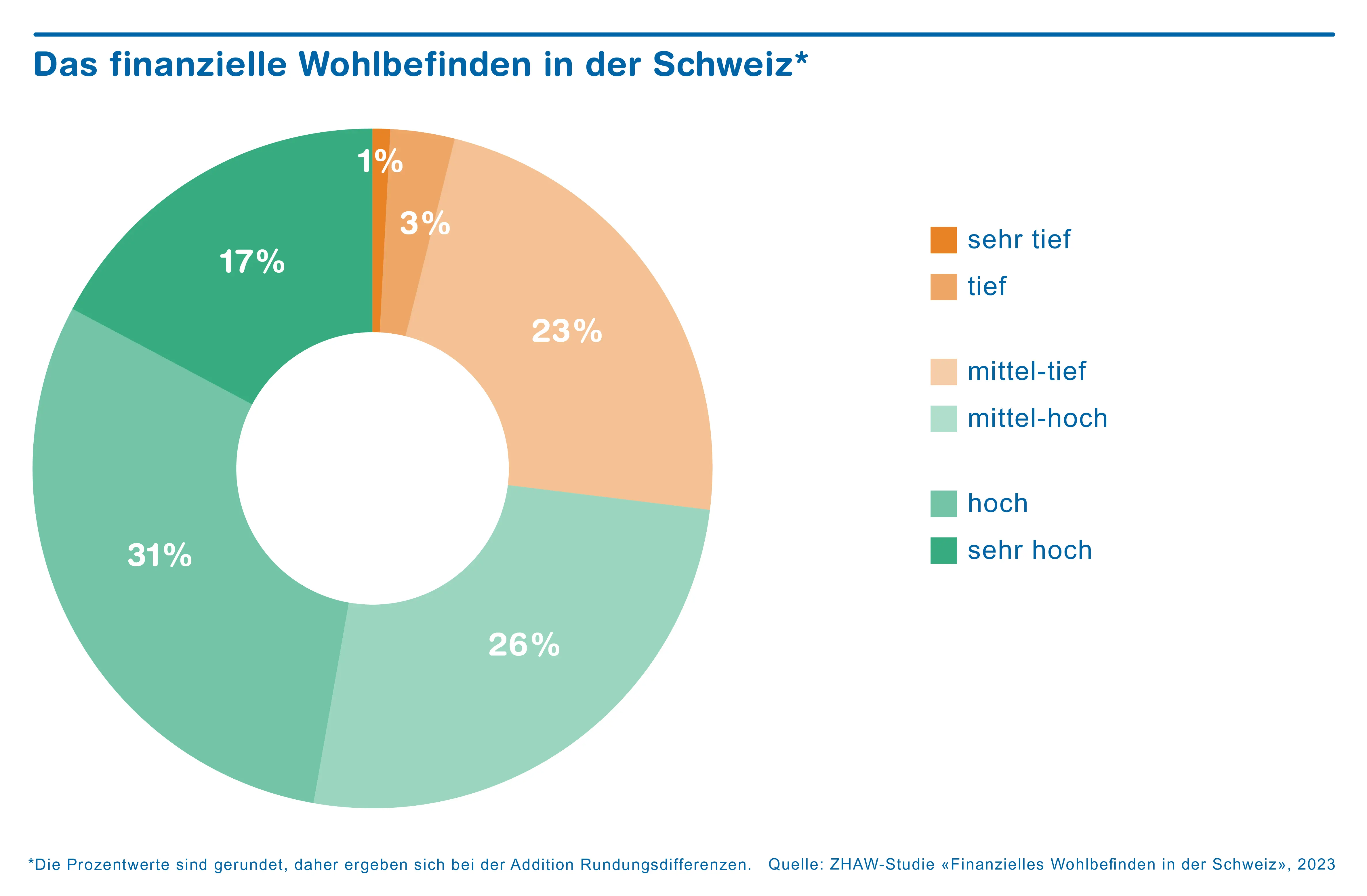

"Relatively little attention is paid to financial well-being, although financial worries can negatively impact other areas of life," explains Selina Lehner of the SML's Department of Banking, Finance, Insurance. Financial well-being is defined as a state in which a person can meet financial obligations and feels secure about their financial future. According to the ZHAW study, only one percent of respondents in Switzerland experience a very low level of financial well-being. A quarter of respondents (25 percent) describe their financial well-being as low-to-medium, and around another quarter (26 percent) have medium-to-high financial well-being. Just under one-third (31 percent) rated their financial well-being as high, while 17 percent rated it as very high.

Dependent on many factors

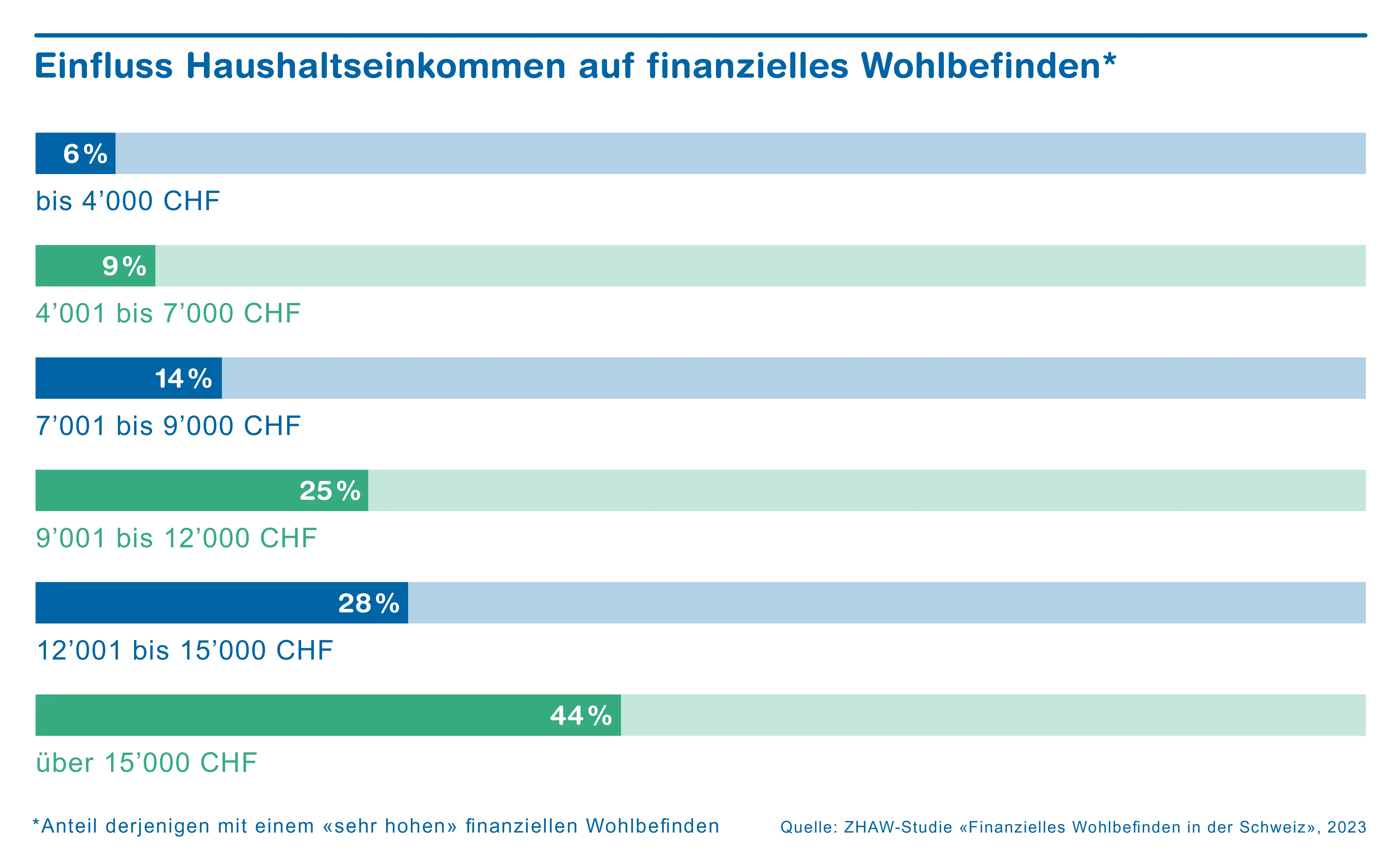

Financial well-being depends on factors such as income, wealth, education, and the housing situation. The ZHAW study also reveals that age has a limited influence on financial well-being, and the older generation is only slightly more financially comfortable. However, women and divorcees often experience lower levels of financial well-being. "Like other countries, we found that a full-time job and a higher level of education also lead to greater satisfaction," explains study leader Selina Lehner. "In addition, homeowners feel more financially secure than those renting." It is, therefore, apparent that there is a broadly positive correlation between income, wealth, and financial well-being. However, a high level of financial well-being does not automatically mean satisfaction with life in general. "Money alone does not make you happy. However, it certainly helps reduce financial anxiety and make everyday life more carefree," comments the SML's Selina Lehner.

Switzerland remains a nation of savers

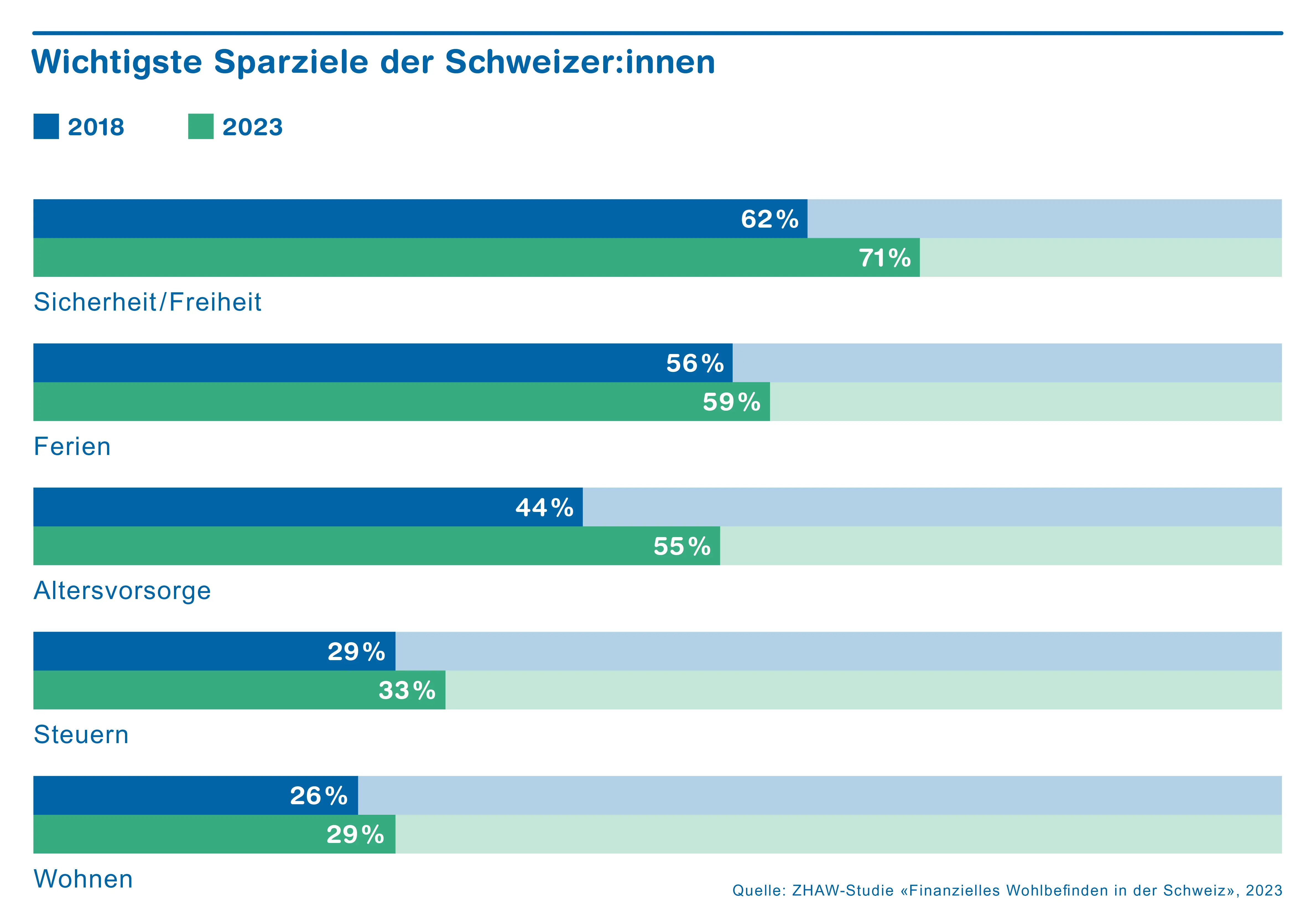

The latest study also shows that savings behavior has only changed slightly compared with 2018. At 81 and 86 percent, respectively, the Swiss as a nation are keen to save and plan for the future. "Year-on-year, we see above all that security savings have gained in importance as a means of cushioning oneself financially against the unexpected," explains Selina Lehner. Almost three-quarters (71 percent) of those surveyed put money aside primarily for "security/financial freedom," followed by "vacations" and "retirement provision." People with a higher level of financial well-being are more likely to save for their old age.

Despite this, saving is not easy for some – perhaps because of their socioeconomic status or personal attitudes. It is also unclear what drives financial behavior. "For example, do some people want to save but simply can't? Or do they choose not to save even though they are in a position to do so?" asks ZHAW researcher Holger Hohgardt. The causes and effects are difficult to assess, he says, and require further investigation.

Financial topics are taboo

The survey findings confirm that people in Switzerland do not like to talk about their finances. Even with those they know very well, only 26 percent of respondents were willing to discuss their financial situation. "That's a pity because finance should be discussed more often since it's fundamental to everyday life," says Selina Lehner. "It turns out that financial well-being can also be achieved with discipline in saving and planning behavior, as well as better financial knowledge." The study authors believe that financial well-being should be included and highlighted at various levels in the future. For example, it could be addressed as a supplementary topic during counseling sessions by financial service providers or within a company's health management program.

"More Income, Fewer Financial Worries?"

The representative study, "More Income, Fewer Financial Worries? – Findings on Financial Well-Being in Switzerland" published by ZHAW examines the impact of finances on the psychology of a private household. A total of 1,054 people in German-speaking Switzerland were surveyed for the study conducted in spring 2023. With findings from the survey, comparisons to 2018 surveys and international comparisons were also made.

Contact

- Selina Lehner, Institute of Wealth & Asset Management, ZHAW School of Management and Law, phone: +41 58 934 46 82, email: selina.lehner@zhaw.ch

- Valerie Hosp, Communications, ZHAW School of Management and Law, phone: +41 58 934 40 68, email: valerie.hosp@zhaw.ch

Downloads

Press Release Financial Well-being(PDF 220,7 KB)

Studie Finanzielles Wohlbefinden 2023 (in german only)(PDF 2,8 MB)

Chart 1: Das finanzielle Wohlbefinden in der Schweiz (in german only)

Chart 2: Wichtigste Sparziele der Schweizer:innen (in german only)

Chart 3: Einfluss Haushaltseinkommen auf finanzielles Wohlbefinden (in german only)