Insurance study 2021-2026

The race for the customer interface has reached a critical juncture

Description

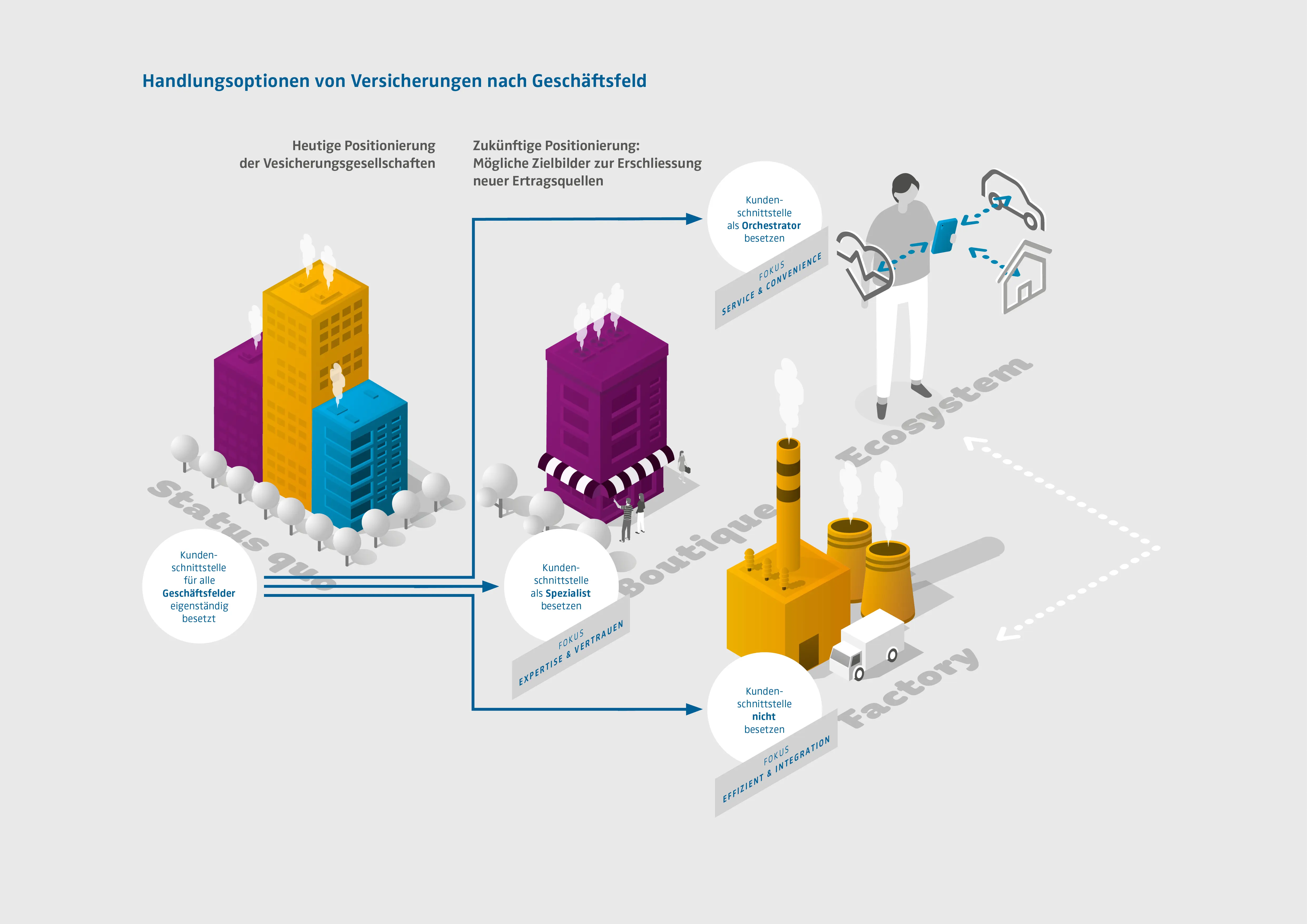

Digitalisation is not a new topic for insurers. First IT-system were already introduced in the 1970’s. Subsequent digitalisation waves included the attempt to go direct via pure digital distribution channels in the noughties. Their limited success as a result of the hybrid interaction patterns of insurance customers then led to broad adoption of omni-channel strategies in the 10’s. In parallel, many insurance companies are investing heavily in renewing their legacy systems.Despite the ongoing changes, one can note that no major transformation, let alone disruption, has occurred in the insurance industry in Switzerland. Established business models persist. Selling traditional products through the existing distribution channels still earns you good money.Since a few years however, signs for an acceleration in change are emerging. Insurtechs are booming, reaching investments of over USD 7bn in 2020. New distribution models via established non-insurance brands, such as Postfinance, IKEA or Migros, are intensifying the competition for the big multi-line insurers. Insurance as a secondary product is increasingly sold as part of the primary product, e.g., the car. Tesla for instance allows you to pick the car insurance in their configurator. Which insurer in the background you picked remains obscure.Our study picks up those trends. We believe Swiss insurers are facing a juncture in the next five years regarding the question of who will be dominating the customer interface. Will it still be the insurer, or will he be pushed to the background? What alternative strategic position can they occupy? What capabilities, technical and personal, will be key for the future? What digital strategy will support those?The present “Insurance Study 2021” forms the staring point of a series of studies that aims at providing decision makers in the Swiss insurance industry a meaningful guidance. For this first study, we have interviewed 13 CxO’s from ten insurance life and P&C insurers in Switzerland. In addition, we have asked 45 experts in an online questionnaire to provide in-depth insights. With that, we were able to cover 80% of the Swiss life insurance and 70% of the P&C insurance market.The study was conducted by the Institute of Risk & Insurance of the ZHAW School of Management & Law in collaboration with Zühlke Group and Synpulse Management Consulting.

Key Data

Projectlead

Lukas Stricker, Silvan Stüssi, Lukas Urech

Project team

Project partners

Zühlke Technology Group AG; Synpulse Schweiz AG

Project status

ongoing, started 01/2021

Institute/Centre

Institute for Risk & Insurance (IRI)

Funding partner

Zühlke Technology Group AG; Synpulse Schweiz AG

Project budget

150'000 CHF