Is Swiss Competitiveness Becoming a Problem?

The business climate index has risen slightly compared to the previous year due to a strong improvement in the service sector. However, industrial companies see themselves in a much more difficult situation today than they did in March 2022.

In terms of specific challenges, this year's Swiss Managers Survey revealed that dependence on immigration, a shortage of skilled workers, and wage pressure are strongly felt by small industrial companies in particular. In competing for talent, 70 percent of the SMEs surveyed also see themselves at a disadvantage compared with large corporations. The companies do not expect any direct negative consequences from the takeover of Credit Suisse by UBS. However, they foresee negative consequences for Switzerland as a business location.

"Swiss Managers Survey" 2023

The fourth Swiss Managers Survey, which was conducted from 17 April to 7 May 2023, asked companies about the business climate and specific challenges faced by managers. In their representative survey, Zurich University of Applied Sciences (ZHAW), University of Applied Sciences Grisons (UAS Grisons), Scuola universitaria professionale della Svizzera italiana (SUPSI), and Haute École Arc (HE-Arc) interviewed alumni of their EMBA and MBA programs. 340 participants from all parts of the country and all relevant industries provided information about their companies. The project’s network partners included the Zurich Chamber of Commerce (ZHK), the Winterthur Chamber of Commerce and Employers' Association (HAW), and the Swiss Chamber of Commerce – Central Europe (SEC).

This year's "Swiss Managers Survey" shows that companies are more positive about developments in the upcoming months than they were in the previous year (March 2022). Only a small minority expect business to deteriorate in the second half of 2023. When it comes to the current business environment, service companies give a very positive assessment – an improvement of 19.5 percentage points on the previous year. However, this view is not shared by industrial companies, whose situation is perceived to be worse than last year.

Martin Hirzel, Chairman of the Advisory Board of the ZHAW School of Management and Law and President of Swissmem, commented on the results of the study as follows: "The results are in line with our information: Capacity utilization is still good thanks to last year's high order volume. However, the recent decline in orders and the low level on the global Purchasing Managers' Index PMI point to more difficult times ahead."

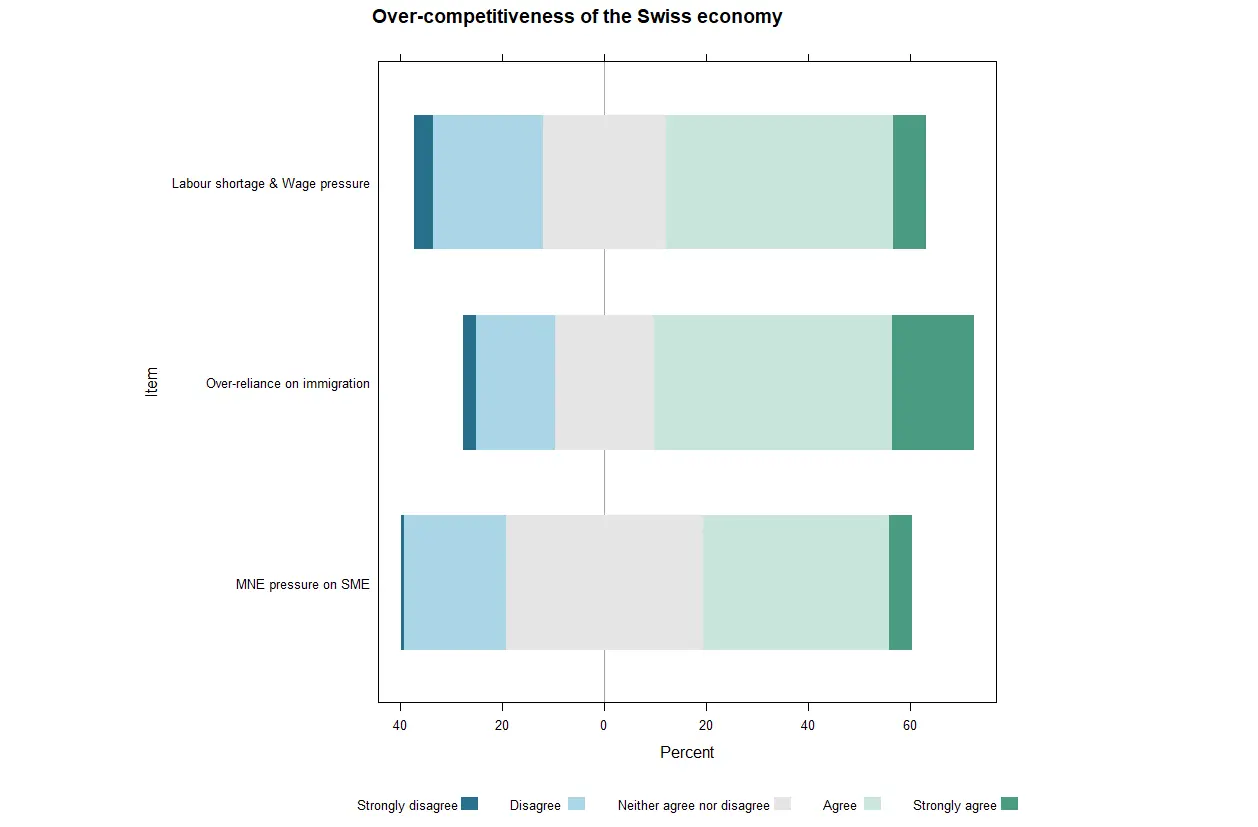

Swiss Competitiveness Has Led to Overdependence on Immigration to Meet Labor Needs

Swiss companies continue to rely on their strengths: Despite higher costs, they are able to compete internationally thanks to high quality and innovative strength. Challenges include a shortage of skilled workers in the Swiss labor market: 51 percent of respondents stated that strong competitiveness has led to labor shortages and wage pressure (higher wages). 63.2 percent of the companies surveyed have rated the strong dependence on immigration as problematic. The losers in this situation are the smaller companies: 70 percent of the SMEs surveyed see themselves at a disadvantage in the battle for talent compared with large companies. "The reasons for these difficulties faced by SMEs could be the better conditions, such as higher salaries or better prospects, that large corporations can offer their employees," said the study’s author Florian Keller, Head of the Center for Global Competitiveness at the ZHAW School of Management and Law, assessing the situation.

The Merger of UBS and Credit Suisse – and Its Impact on Swiss Companies

Although the takeover of Credit Suisse by UBS is seen as a reputational risk for Switzerland as a business location, no negative consequences are expected for the company's own business. Only a small minority of the Swiss managers surveyed (13.6 percent) believe that the merger of the two big banks will have negative consequences for their own company. "We were surprised that the managers surveyed do not expect negative consequences for their business, such as more expensive loans, as a result of the takeover of CS by UBS," ZHAW Professor Florian Keller said. 61.8 percent of the participants, on the other hand, are convinced that Switzerland as a business location has suffered as a result of this takeover.

Supply Chain Risk: Focus on Europe and Larger Storage Capacities

For 56.2 percent of industrial companies, their supply chains are currently the greatest risk. The companies concerned see promising counterstrategies mainly in procurement from Europe and in building up warehouse capacities.

The managers are not unanimous about domestic procurement: "It is apparent that for some companies, domestic procurement is a successful strategy – for others, where this option does not exist, access to the European procurement market is key,” according to the study’s leader, Prof. Keller (ZHAW), who continued: “The survey also shows that access to foreign markets is essential for Swiss competitiveness: Only 5.7 percent of participants do not see this as significant.”

While the industrial sector is struggling with supply issues, other companies are faced with other risks: More than 85 percent of companies that cited cyber risks as their biggest threat have fewer than nine employees. Among mid-sized companies, two-thirds say that financial risks such as exchange rate fluctuations, inflation, or rising interest rates are the most pressing among their concerns.

Contact

Prof. Florian Keller, Head of ZHAW Center for Global Competitiveness, School of Management and Law

phone: + 41 58 934 46 97, email florian.keller@zhaw.ch

Valerie Hosp, Communications, ZHAW School of Management and Law

phone: +41 58 934 40 68, email valerie.hosp@zhaw.ch