Ten Percent of Swiss Residents Use Neobanks

Neobanks are on the rise in Switzerland. Every tenth person has already used these new online banking solutions, as the latest Swiss Payment Monitor of ZHAW and the University of St. Gallen shows. At the same time, the eradication of cash is not an option for the majority of the population.

One-tenth of Swiss residents have already used new online banking solutions provided by neobanks at least once. They are particularly common among males as well as younger and more educated people with higher incomes. In total, around two out of five people in this country are familiar with at least one of the better-known neobanks. This is confirmed by the Swiss Payment Monitor – conducted for the third year running by the ZHAW School of Management and Law and the University of St. Gallen. More than 1,200 subjects throughout Switzerland were questioned for this survey at the end of 2019.

Used for Payments Abroad

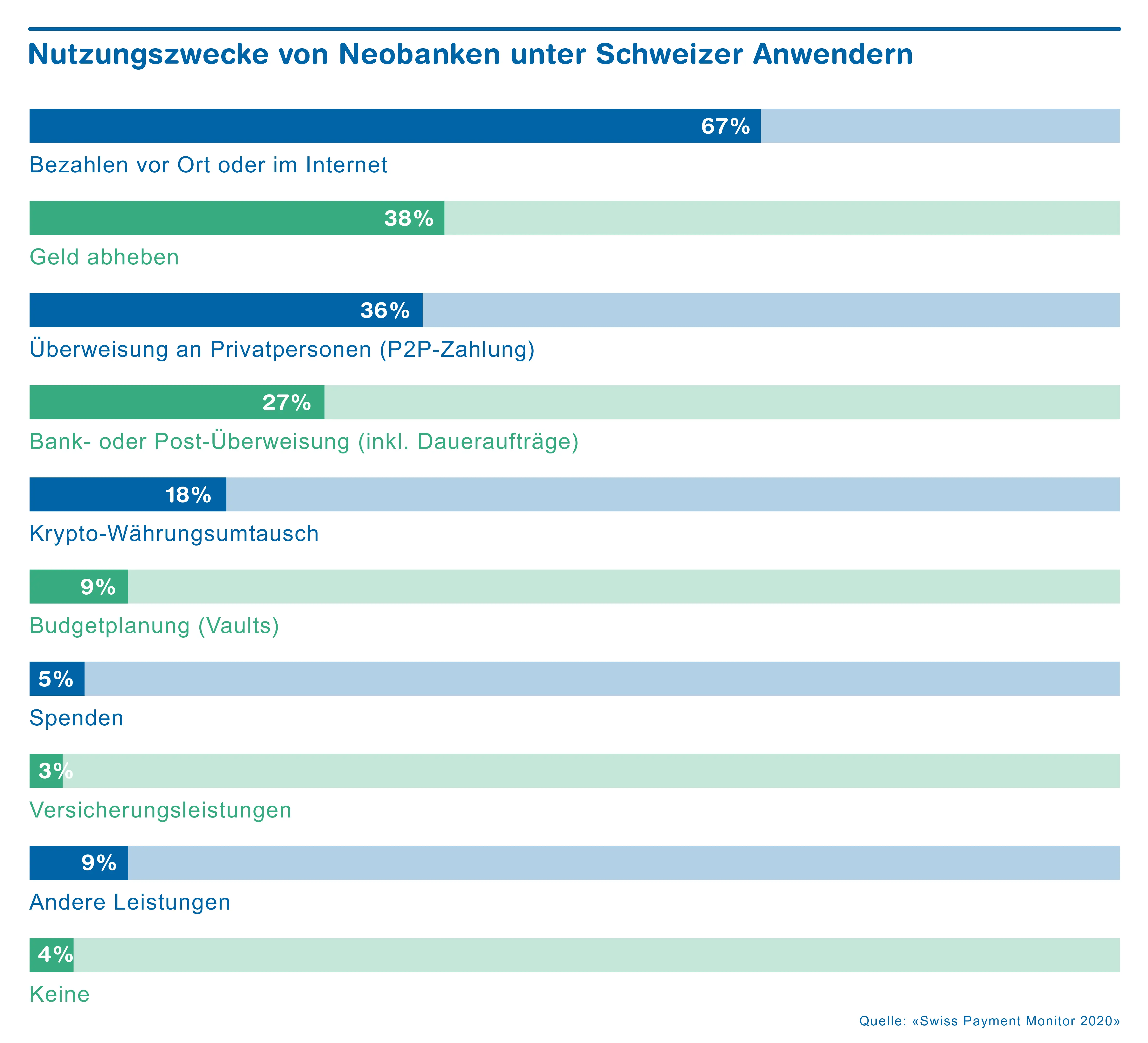

Three-quarters of neobank users take advantage of these exclusively online banking services in addition to having a traditional banking service provider. “At present, neobanks function primarily as niche products, especially for making payments when traveling abroad,” explains Tobias Trütsch, payment economist at the University of St. Gallen. Only around 10% of neobank users have canceled the services of a conventional provider in favor of these new digital-only services and another 10% intend to do so.

The main reasons for the popularity of neobanks are their practical and straightforward handling and competitive fee structure, particularly the favorable foreign exchange rates. The best-known neobank businesses in Switzerland are Revolut (26% awareness share) and Zak (16%). Revolut is most frequently used (7% usage share) together with Transferwise, a UK provider (3%). In terms of security perception, however, Swiss neobanks Zak and Neon lead the field.

No to the Cashless Society

Despite new digital solutions, the eradication of cash as a means of payment is not an option for around three-quarters of those surveyed, and half reject the idea altogether. “This is a highly emotive topic for many people,” says ZHAW payment expert Sandro Graf. Only about one-fifth are entirely in favor of a cashless Switzerland. “The main arguments against the abolition of cash, in the view of the respondents, are the loss of the value of money, a lack of control over personal finances, dependence on technology, and various security concerns such as cyber attacks or technical breakdowns,” explains Graf. Other factors include the loss of anonymity, fears of monitoring by the state or financial institutions, and less flexibility regarding means of payment.

Freedom of Choice is Important

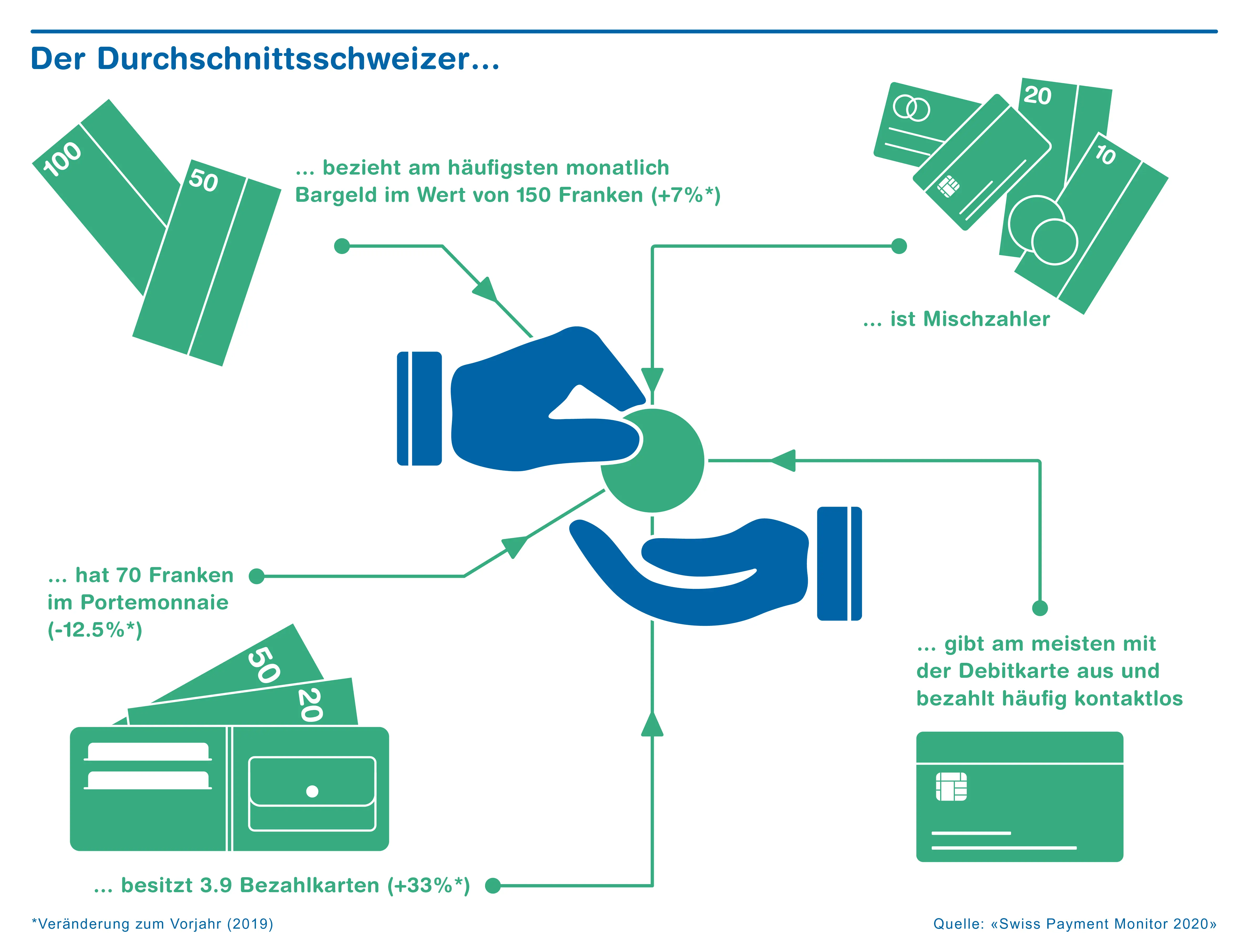

In general, respondents value freedom of choice. Around 75% of the subjects surveyed believe that it should always be possible to pay by cash, or electronically by card. The most popular means of payment is still the debit card. This is the method people use to spend the most money – namely 28 % of their outgoings – followed by cash (23 %) and credit card (21 %). Measured by the number of transactions, cash is the most frequently used payment instrument, accounting for 45 % of all transactions. However, its use has declined by around three percentage points year-on-year in terms of both revenue and the number of transactions. On average, every Swiss resident still carries around 70 Swiss francs in cash on his or her person.

Most people, especially females and young people, are very mindful of others when choosing how to pay. For example, they assume that service staff in the hospitality sector prefer cash payments, especially for small amounts. “This is due to the tipping effect,” says Trütsch. “The Corona crisis has led to a dilemma for many guests because businesses have been encouraging contactless payments.”

Swiss Payment Monitor

The Swiss Payment Research Center (SPRC) at the ZHAW School of Management and Law and the Executive School of Management, Technology and Law (ES-HSG) at the University of St. Gallen have been working independently on payment issues for several years. Together they have been conducting the Swiss Payment Monitor annually since 2018. When it was initially published, this was the first Swiss payment study to combine a consumer perspective with a macroeconomic viewpoint. The combination of online surveys and subjects’ journals, as well as a link to public data from the Swiss National Bank (SNB), enables methods of payment on a day-to-day basis to be depicted realistically. A total of more than 1,200 subjects aged between 18 and 65 from all three linguistic areas of the country were surveyed on a representative basis in November and December 2019. This study is financed by the two research institutions, the Swiss Payment Association (the industry organization for all leading Swiss issuers of credit cards on behalf of the international card organizations), and industry partners Concardis and SIX Payment Services.

Contacts

Sandro Graf, Head of Service Lab, ZHAW School of Management and Law, Phone + 41 (0)58 934 46 46, e-mail sandro.graf@zhaw.ch

Dr. Tobias Trütsch, Head of Economics Division, University of St. Gallen, Phone + 41 (0)71 224 75 14, e-mail tobias.truetsch@unisg.ch

Frederic Härvelid, Communications, ZHAW School of Management and Law, Phone + 41 (0)58 934 51 21, e-mail oscarfrederic.haervelid@zhaw.ch