Credit Cards Now Highest-Grossing Payment Method

The credit card has grown massively in importance since the beginning of the pandemic. In addition, contactless payment is becoming the new standard, with the strong growth of mobile phone payments also contributing to this. This is confirmed by the current Swiss Payment Monitor published by ZHAW and the University of St. Gallen.

(Note: News release, study, illustrations and video are only available in German)

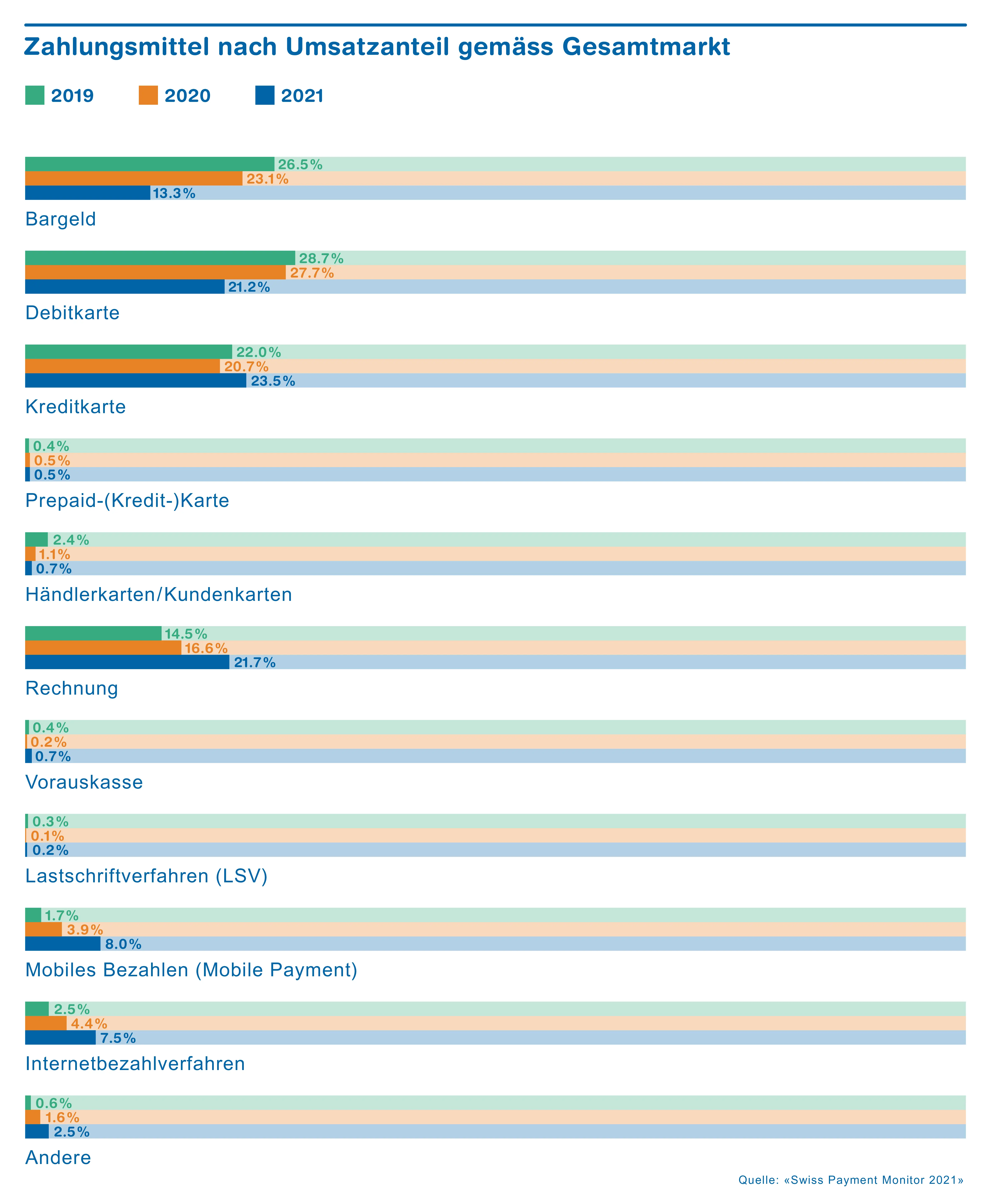

The credit card is the payment option with the highest turnover, accounting for 24 percent of spending, followed by the invoice (22 percent), debit card (21 percent), and cash (13 percent). This is confirmed by the Swiss Payment Monitor (the fourth such survey) carried out by ZHAW and the University of St. Gallen. At the end of 2020, more than 1,400 people – representative of all of Switzerland – were interviewed for the study.

Cash is the most frequent means of payment

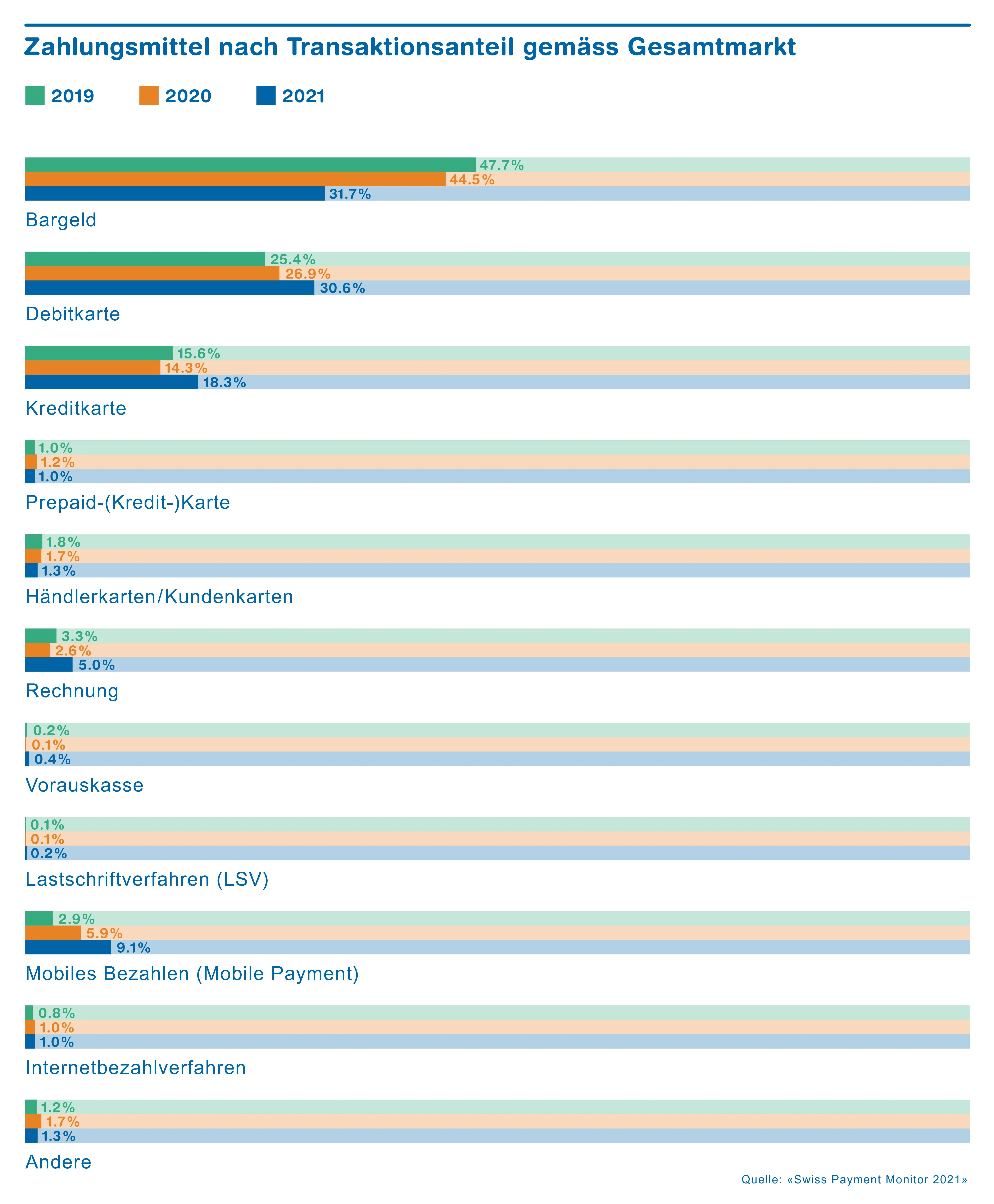

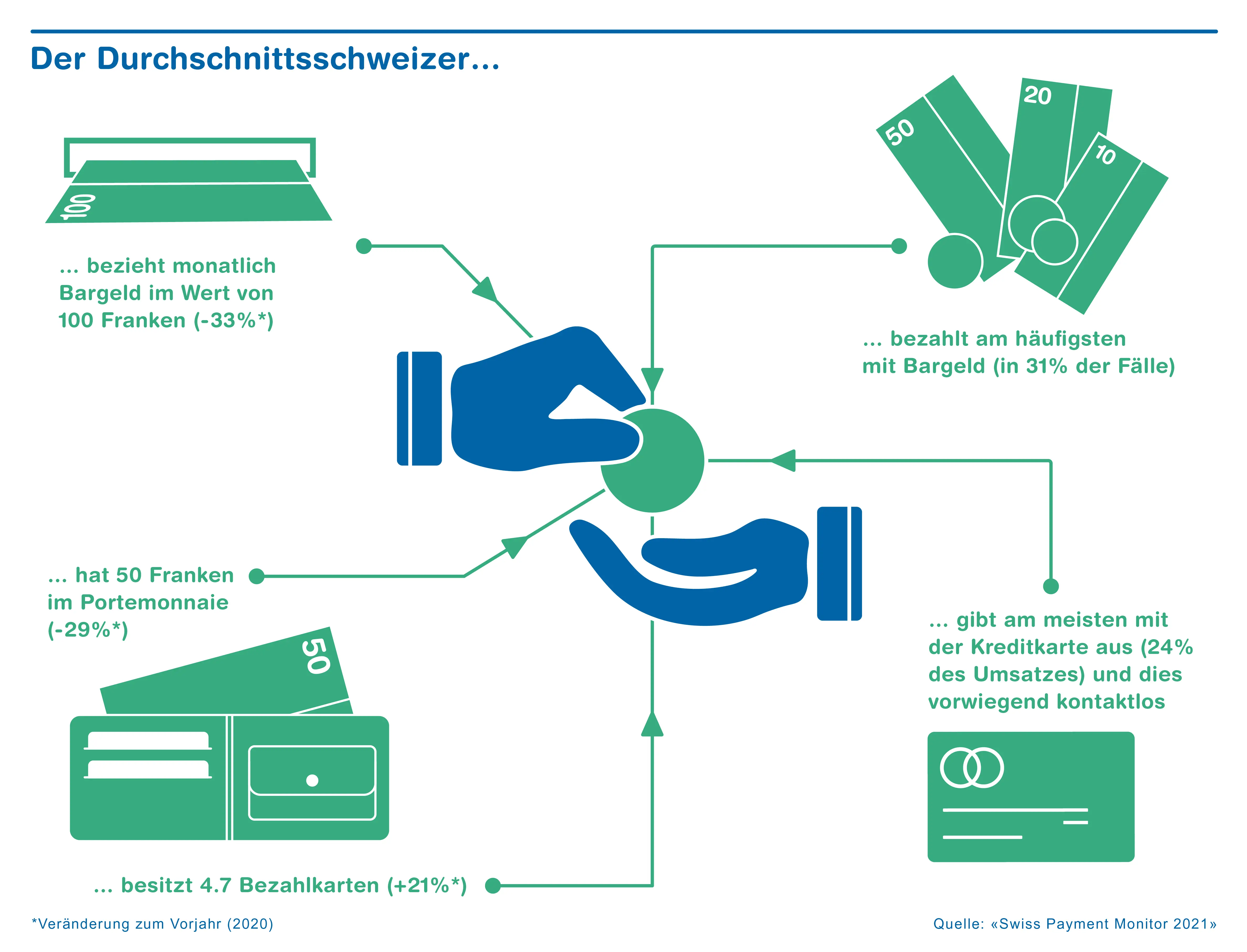

Compared with the previous year, the credit card has knocked the debit card off the top spot. "This is mainly due to an increase in online purchases since the outbreak of the corona pandemic," explains ZHAW payment expert Marcel Stadelmann. In terms of the number of transactions, cash is still the most frequently used payment method with a share of 32 percent, just ahead of the debit card at 31 percent. However, the use of cash fell by around 10 percentage points in terms of turnover and about 13 percentage points in terms of the number of transactions compared with the previous year. This shows that the number of smaller amounts being paid without cash is on the rise. A Swiss resident now only carries, on average, around 50 francs in cash (a fall of 29 percent).

Every tenth payment is made using a mobile device

Payments with mobile devices – especially mobile phones – have more than doubled within a year in relation to the share of sales, and the number of transactions has also increased by more than half. "Almost 10 percent of all transactions are now processed with a mobile device, regardless of the amount," says Tobias Trütsch, payment economist at the University of St. Gallen. "Growth has been enormous, especially for small amounts and online payments." In distance business, where the customer is not present at the point of sale, mobile payments make up the largest share with almost 30 percent of all transactions, followed by invoices (29 percent) and credit cards (22 percent).

Most mobile payments are made using apps with an integrated payment function (21 percent of transactions using mobile devices). One example of this is purchasing tickets for public transport through dedicated apps. In addition, many people use mobile phones to pay in shops via a QR code (20 percent) or contactless data transmission (NFC) (13 percent). In-app payments are also the mobile form of payment that people like best, followed by transfers to private individuals using payment apps such as TWINT as well as online payments with QR codes and stored payment data.

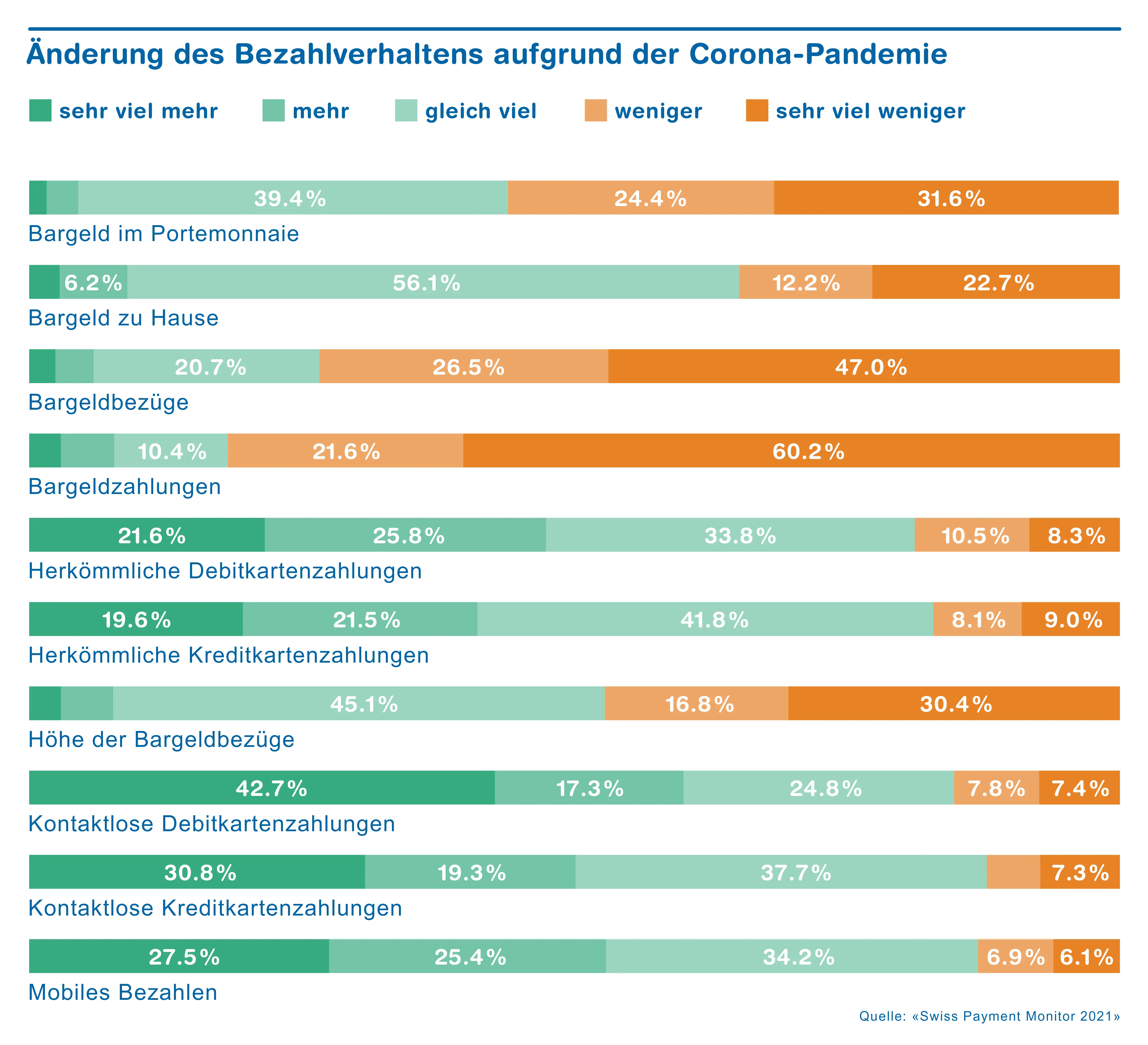

Pandemic promotes contactless payment

Contactless payment is the new standard not only with mobile phones but also with payment cards. Around 60 percent of all transactions and 50 percent of sales with payment cards are now made using the contactless feature. Since the outbreak of the pandemic, the corresponding figures have increased by around 10 percentage points. "In particular, an increase in the limit for contactless payments without a PIN to CHF 80 and retailer requests for contactless payment were decisive," explains Tobias Trütsch.

One-fifth use neobanks

One-fifth of Swiss residents have already used new online banking solutions from neobanks at least once. Their use is particularly widespread among men and in German-speaking Switzerland. Overall, around two-thirds of people in this country know at least one of the most common neo-banking providers. The best known are CSX from Credit Suisse (40 percent awareness), Revolut (37 percent), and Zak (29 percent). British provider Revolut is used most frequently (10 percent of those surveyed), followed by TransferWise, also from the UK, and Swiss provider Neon (both 6 percent).

The main reasons given for using neobanks were straightforward and practical handling as well as quick transfer and constant availability. "Interestingly, the advantageous fee structure and, in particular, favorable exchange rates are no longer as important as in previous years," says Marcel Stadelmann. Sixty percent of neobank users take advantage of these online services in addition to conventional banking service providers. Around 10 percent have now closed their accounts with traditional providers in favor of new online banking services, and 30 percent intend to do so in the future.

Swiss Payment Monitor

The Swiss Payment Research Center (SPRC) at the ZHAW School of Management and Law and the Swiss Payment Behavior Lab at the University of St. Gallen have been working independently on payment-related issues for many years. Together they have conducted the Swiss Payment Monitor annually since 2018 – and every six months since 2021. When it was first published, this was the first Swiss payment study to combine consumer and macroeconomic perspectives. The daily use of means of payment can be mapped realistically through a combination of online surveys and diary surveys as well as a link with public data supplied by the Swiss National Bank (SNB). A total of over 1,400 people between the ages of 18 and 75 from all three linguistic parts of the country were interviewed between the end of November and mid-December 2020. This study is financed by the two research institutions, the Swiss Payment Association (branch organization of all major Swiss credit card issuers of the international card organizations) and industrial partners Concardis and Worldline | SIX Payment Services.

Downloads und Links

- Medienmitteilung «Kreditkarte neu umsatzstärkstes Zahlungsmittel» (PDF 331 kB)

- Kurzbericht «Swiss Payment Monitor 2021 – Wie bezahlt die Schweiz?» (PDF 2.45 MB)

- Chart «Der Durchschnittschweizer...» (JPG 1.62 MB)

- Chart «Zahlungsmittel nach Transaktionsanteil gemäss Gesamtmarkt» (JPG 2.36 MB)

- Chart «Zahlungsmittel nach Umsatzanteil gemäss Gesamtmarkt» (JPG 2.35 MB)

- Chart «Änderung des Bezahlverhaltens aufgrund der Corona-Pandemie» (JPG 2.53 MB)

- Website «Swiss Payment Monitor»