Significantly Fewer Cash Payments Nowadays

For the first time since the COVID-19 pandemic, the Swiss population has been using cash much less frequently. Mobile payments, however, are growing steadily and used almost as frequently as cash. The Swiss Payment Monitor conducted by the ZHAW and the University of St. Gallen also reveals that debit cards continue to extend their lead as the most popular means of payment.

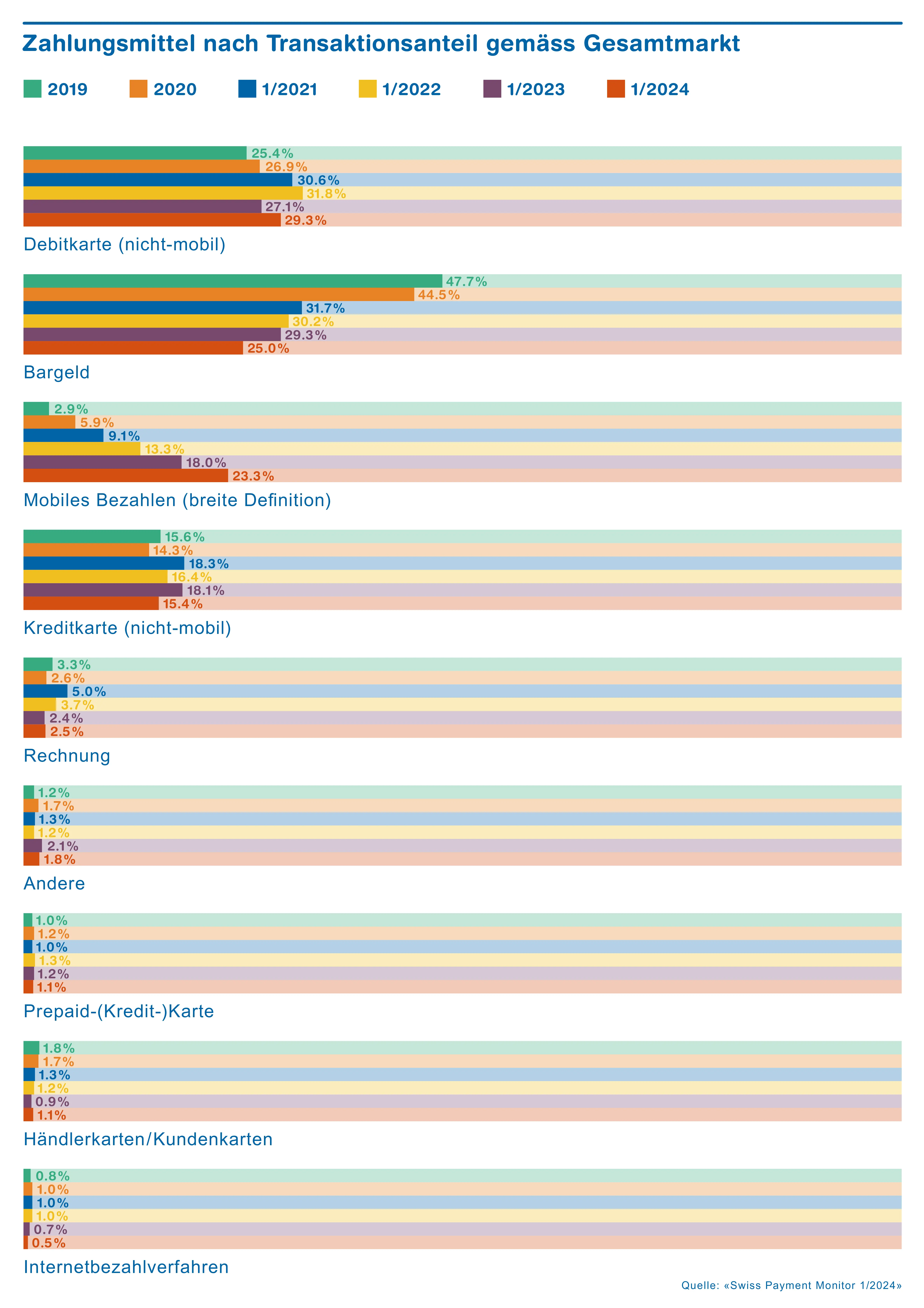

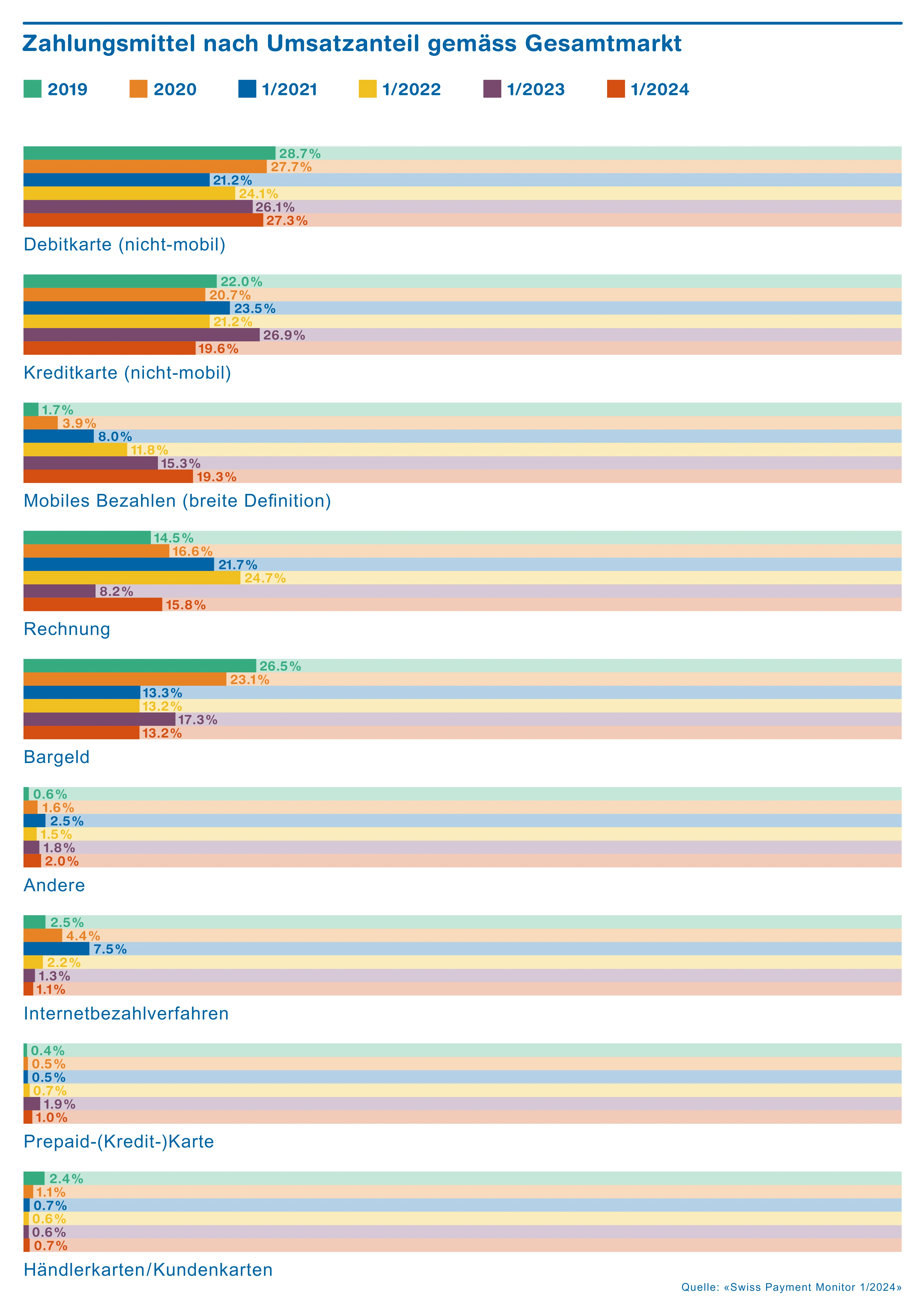

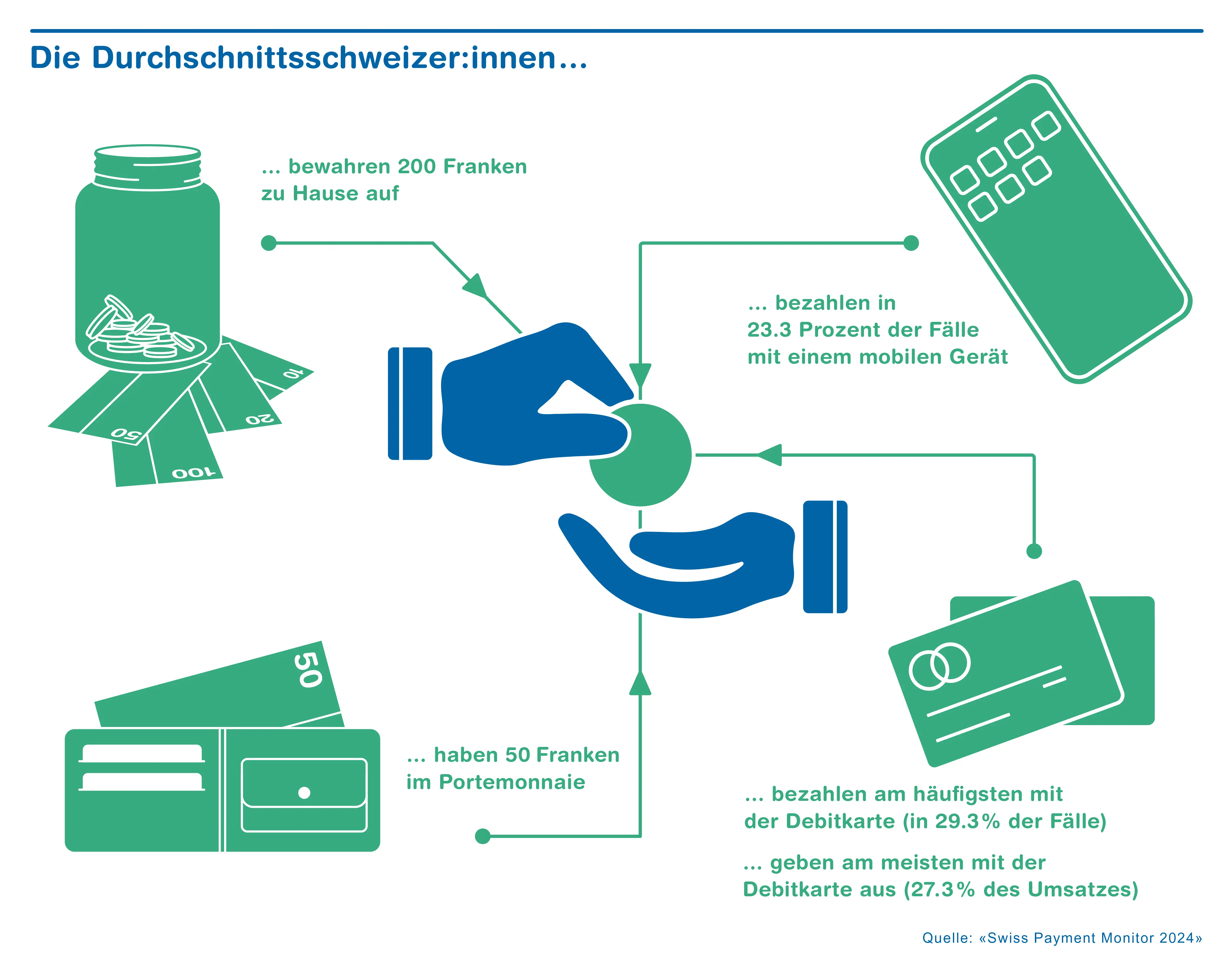

The proportion of cash payments in Switzerland fell significantly for the first time since the outbreak of the COVID-19 pandemic in 2020 (-3.2 percentage points). However, cash remains in second place with a quarter of all transactions – but only just ahead of payments with mobile devices such as mobile phones, tablets, or smart watches (23.3%). Increasing its lead, the debit card continues to be the most popular payment method (29.3%). These are the findings of the tenth Swiss Payment Monitor carried out by the ZHAW School of Management and Law and the University of St. Gallen. For this study, around 1,700 people were surveyed in October and November 2023 on a representative basis for the whole of Switzerland.

Debit card use increases for in-person payments

The debit card consolidated its leading position as a means of payment at the point of sale, both in terms of turnover with a share of 41.2% (+3.5 percentage points) and number of transactions at 37% (+2.1 percentage points). The credit card follows in second place for face-to-face transactions with a 29.1% share (-3.2 percentage points) and third place in terms of the number of transactions at 21.6% (-0.4 percentage points). This includes payments with e-wallets such as Apple Pay, Samsung Pay, and Google Pay, which store users’ debit or credit card details. “Around one in three credit card payments and 13% of all debit card payments are now made using mobile devices with stored payment details, such as Apple Pay, Samsung Pay, and Google Pay,” says payment methods expert at ZHAW, Dr. Marcel Stadelmann.

Cash is still the second most frequently used in-person payment method, with a share of 29.2% (-2.9 percentage points). Following strong growth between November 2022 and May 2023, TWINT payments linked directly to a bank account – mobile payment in the true sense of the word – only increased slightly to a share of 7.2% (+0.3 percentage points) for face-to-face transactions.

Polarized attitudes toward the abolition of cash

The majority of Switzerland’s population consider access to cash in their everyday lives to be “fairly good” (53%) or “very good” (32%), while the remainder rate it as “somewhat poor” (13%) or “very poor” (2%). However, almost half of those surveyed believe that access to cash has deteriorated at least somewhat (36%) or even significantly (10%) in recent years. “The subjective perception of Switzerland’s population coincides with objective measures of cash access,” explains Dr.Tobias Trütsch, payment economist at the University of St. Gallen.

Attitudes toward the possible abolition of cash are constantly changing, with the proportion of those who are neither for nor against abolition falling steadily. Instead, there has been an increase to 44.3% in the proportion of the population clearly against the abolition of cash. Older respondents were more strongly opposed to the abolition of cash. In contrast, there is growing support for a cashless society among the younger age groups. “It is interesting to note that while more and more respondents are speaking out against the abolition of cash, it is actually being used less and less often to make payments,” observes Tobias Trütsch.

Support for a cash acceptance obligation

A majority of 61% would welcome the proposed introduction of a cash acceptance obligation in Switzerland, whereas slightly under 20% of respondents were against this. In contrast, 41% of respondents favored an obligation for vendors to accept cashless payments, while 37% disagreed. “From feedback on the reasons for their answers, it is clear that those in favor place the highest value on individual freedom of payment choices from the consumers’ perspective,” says Marcel Stadelmann.

Swiss Payment Monitor

The Swiss Payment Monitor is published every six months to provide an up-to-date picture of developments in the payment behavior of Swiss residents. It was published for the first time in 2018 and is based on representative survey data from an online and journal survey as well as public data from the Swiss National Bank. From mid-October to mid-November 2023, around 1,700 people aged 18 or over from the three main language regions of the country were surveyed on a representative basis about their payment habits and attitudes towards new means of payment. The Swiss Payment Monitor is published by the Swiss Payment Research Center at the ZHAW School of Management and Law and the Swiss Payment Behavior Lab at the University of St. Gallen. The study is financed by the two named research institutions, the Swiss Payment Association (the industry organization for all major Swiss issuers of credit cards on behalf of international card organizations), and industry partners Nexi and Worldline.

Contacts

- Dr. Marcel Stadelmann, Senior Researcher, ZHAW School of Management and Law, phone +41 58 934 46 46, email marcel.stadelmann@zhaw.ch

- Dr. Tobias Trütsch, Managing Director, Center for Financial Services Innovation, University of St. Gallen, phone +41 71 224 71 55, email tobias.truetsch@unisg.ch

- Valerie Hosp, Kommunikation, ZHAW School of Management and Law, phone +41 58 934 40 68, email valerie.hosp@zhaw.ch