The Online Retail Boom Is Continuing

Nine out of 10 online stores in Switzerland and Austria have grown during the pandemic and half have gained a very large number of new customers. Around 40 percent also report a higher order frequency. In addition, most expect additional growth in the future, as a ZHAW study shows.

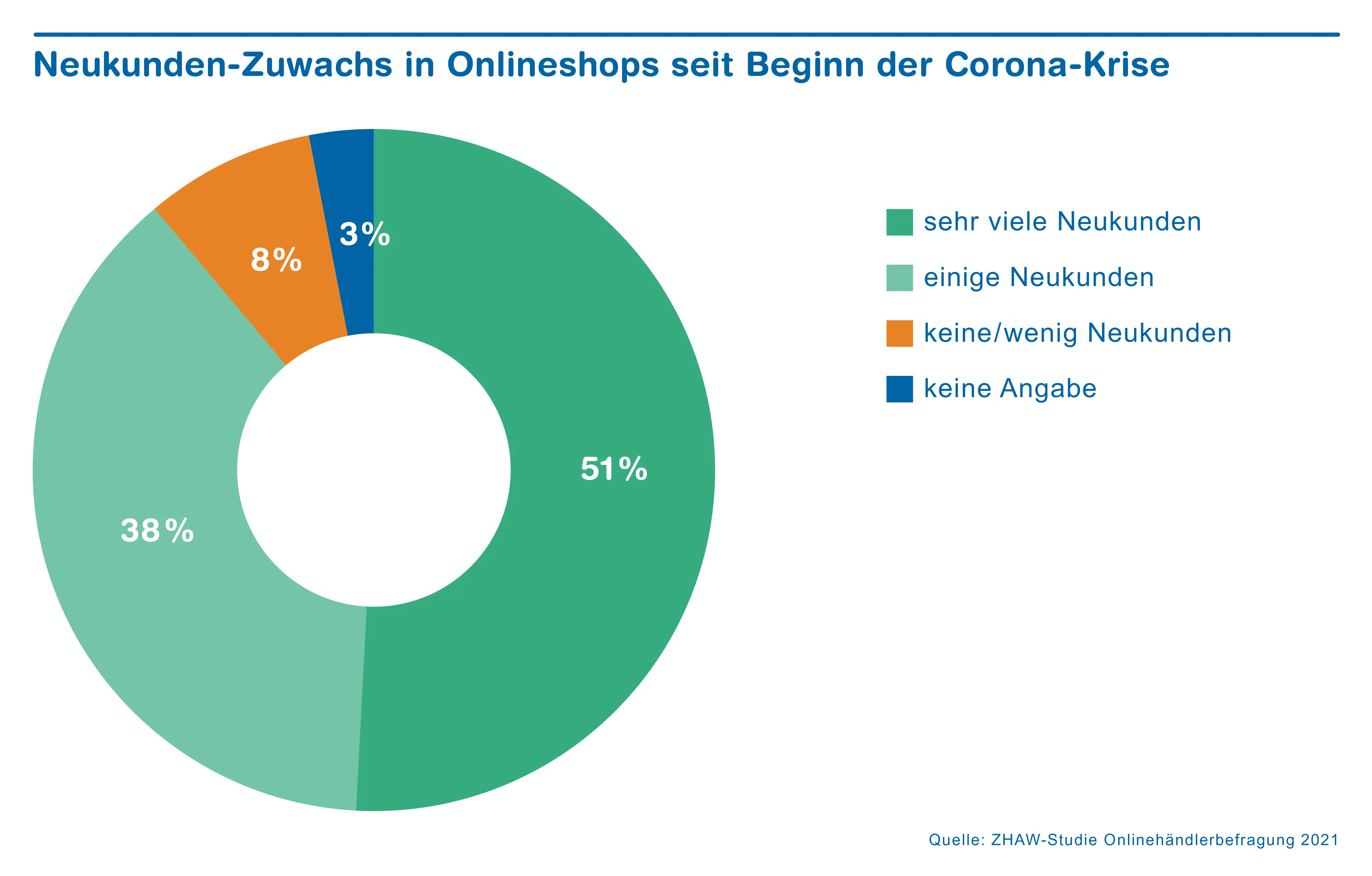

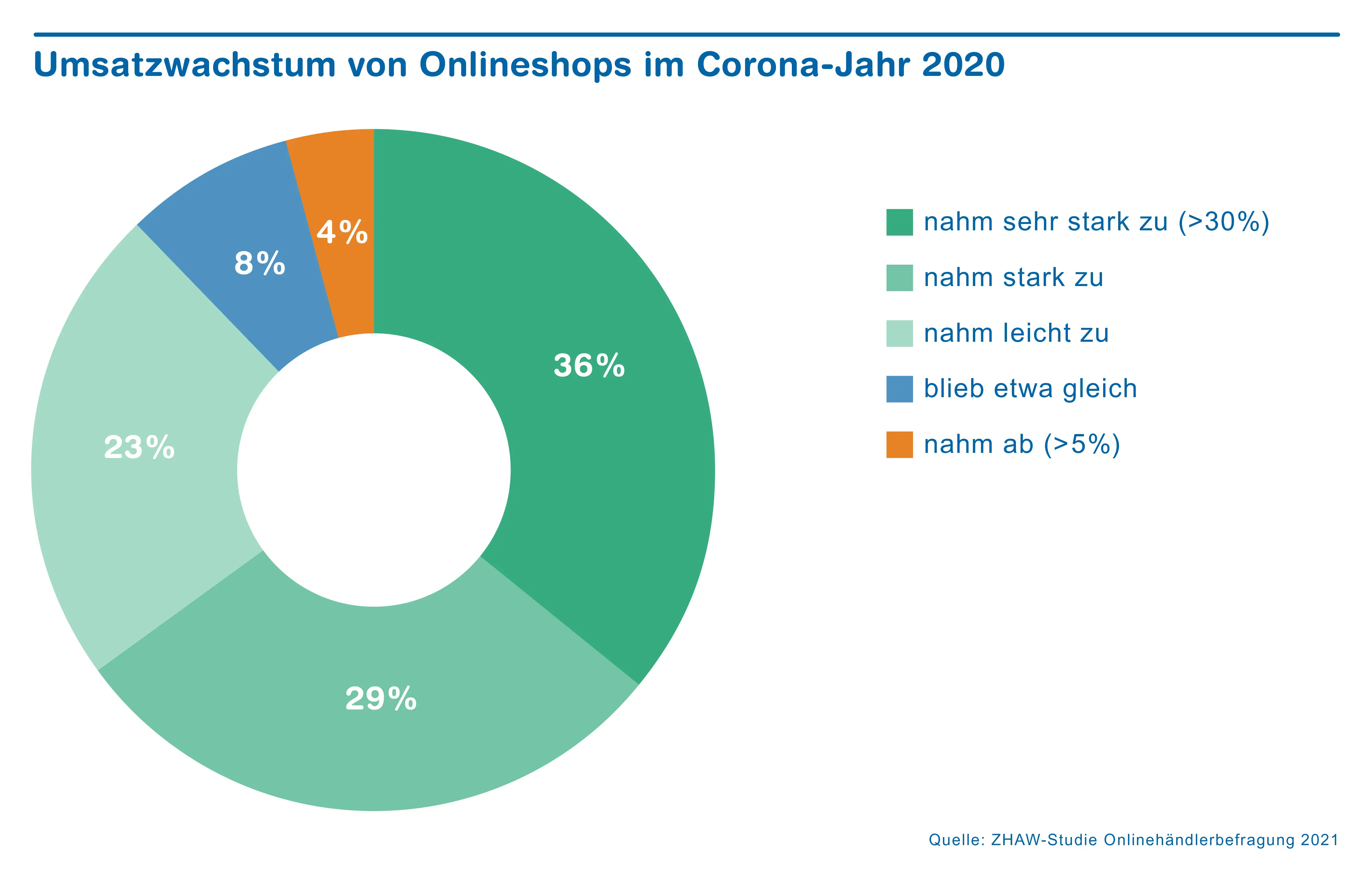

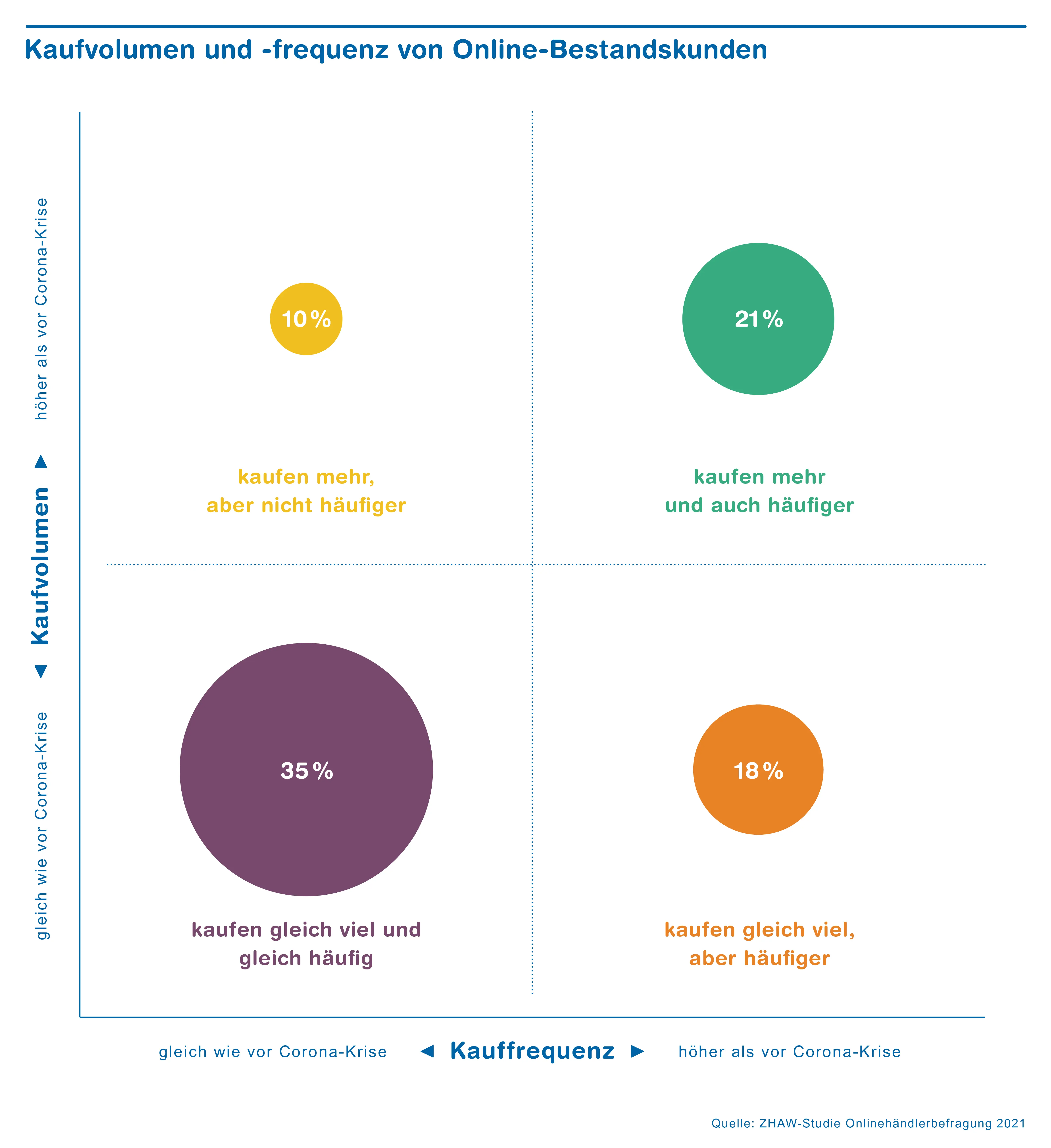

The strong growth in online trade since the start of the pandemic is still ongoing. Nine out of 10 online store operators in Switzerland and Austria have gained new customers over the last year, and 51 percent of them a great many. Moreover, consumers are buying more frequently from around 40 percent of providers, and from one in two of them also in larger quantities. 88 percent of online retailers reported a rise in sales in 2020, with more than one-third experiencing over 30 percent growth, which is considerable. These are the results of the current online retailer survey of 365 online stores conducted by the ZHAW School of Management and Law.

Record sales expected

“Many online stores have benefited in three ways in the recent past: from the influx of new customers, higher purchase volumes, and higher purchase frequencies," says ZHAW researcher Darius Zumstein. "Overall, we estimate that sales in Swiss online retail will reach at least 15 billion Swiss francs in 2021. That's an increase of almost 50 percent compared to 2019." 92 percent of online retailers also expect sustainable growth in the post-pandemic period, which is expected to be strong (23 percent) or moderate (69 percent).

The online stores surveyed by ZHAW had an increase in orders in 2020 compared to 2019 that affected all product groups. Particularly affected were garden and do-it-yourself articles, toys, furniture and sports equipment, and food. The very strong demand for computer, multimedia, and electronic equipment in the spring of 2020 has leveled out somewhat in the meantime.

New jobs

To cope with this growth, the majority of online retailers hired additional staff, for example in warehousing and order processing. Many so-called omnichannel merchants, which operate both physical and online stores, have expanded or upgraded their e-commerce departments. According to Zumstein, "the Corona crisis has brought about a significant digitization push in this regard." Many online retailers have continued to invest in expanding their warehouse capacity and in their IT systems. More than half now also sell their products on virtual marketplaces such as Digitec Galaxus or Amazon. That is significantly more than in 2019.

Intensified competition

Current challenges facing online retailers include problems with procurement: Around three out of four suppliers state that suppliers are delayed or unable to deliver at all. In addition, 70 percent are experiencing increasing competition and price pressure. Among omnichannel providers, more than half expect there to be fewer brick-and-mortar stores in the coming years. "Some of the operators will probably increasingly rely on new store formats, such as experience stores or showrooms where only selected products from the online range are presented and sold," says Zumstein.

The standard payment options of online retail are still the same as in previous years: credit card and invoice. The proliferation of mobile processes has increased once again. For instance, 52 percent of the stores surveyed offer payment via TWINT. Technically, transactions are processed mainly via PayPal, Post Finance, Worldline, and Datatrans.

The fourth edition of the survey

The Online Retailer Survey 2021 was conducted from 8 June to 4 September 2021 by the Institute of Marketing Management at the ZHAW School of Management and Law. 365 online stores in the areas of business-to-consumer (B2C) and business-to-business (B2B), as well as online manufacturer stores, took part in the online survey. Besides 284 Swiss retailers, another 63 retailers from Austria were also represented for the first time. This enables comparisons to be made between the two neighboring countries. The survey was published for the fourth time this year.

Downloads

Press Release Online Retail Boom(PDF 232,2 KB)

Study Online Retailer Survey 2021(PDF 2,6 MB)

Grafik Kaufvolumen und-frequenz von Onlinebestellungen

Grafik Neukunden-Zuwachs in Onlineshops seit Beginn der Corona-Krise

Grafik Veränderung Onlinebestellungen nach Produktgruppen

Contact

Darius Zumstein, ZHAW School of Management and Law, Institute of Marketing Management, phone: +41 (0)58 934 66 08, email: darius.zumstein@zhaw.ch

Frederic Härvelid, ZHAW School of Management and Law, Communications, phone: +41 (0)58 934 51 21, email: frederic.haervelid@zhaw.ch