Swiss firms face key challenges in complying with ESG reporting standards

The importance of ESG activities has increased for many Swiss companies. Nevertheless, the majority of companies are not prepared for a corresponding reporting. Only about 40 percent of Swiss firms will publish an ESG report. Over the past three years, the importance of environmental, social, and governance issues has increased for managers, with environmental aspects experiencing the most significant growth in significance. Managers recognize the strategic value of ESG data, but its effective use to increase business success requires further development. This is shown by a recent survey of Swiss companies conducted by the ZHAW School of Management and Law.

In April and May 2024, the fifth "Swiss Managers Survey" was conducted to gather insights from Swiss companies on ESG (Environmental, Social, and Governance) issues. The survey, led by the Zurich University of Applied Sciences (ZHAW), the University of Applied Sciences Graubünden (FH Graubünden), the Scuola universitaria professionale della Svizzera italiana (SUPSI), and the Haute École Arc (HE-Arc), involved over 400 managers from across the country. This representative survey provides a comprehensive overview of the ESG climate in Swiss companies.

Legal implications for ESG reporting

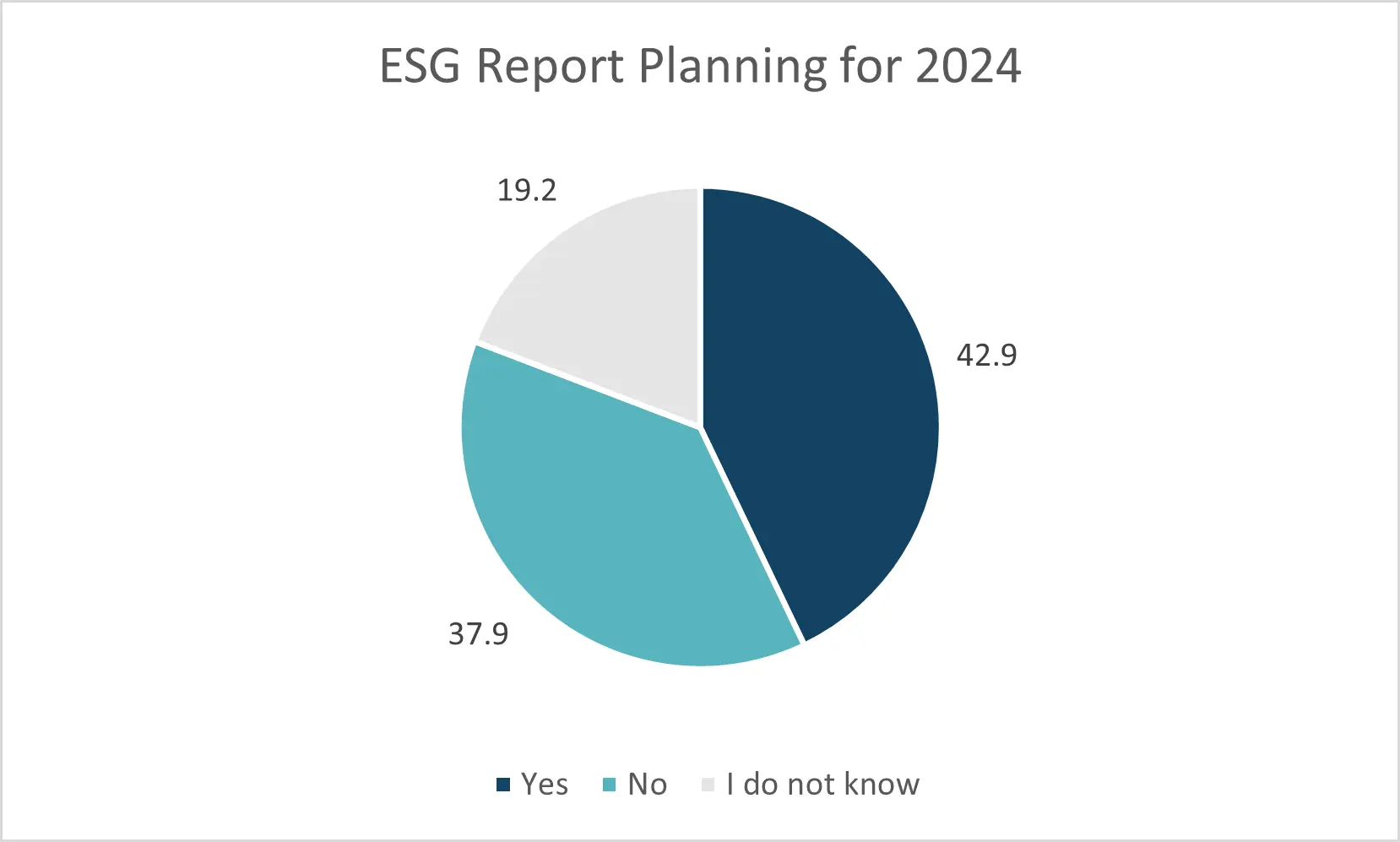

The recent introduction of Corporate Sustainability Reporting Directives (CSRD) in the European Union and the regulation on mandatory climate reporting in Switzerland has raised the priority of ESG for many managers. Nevertheless, a significant proportion of companies do not appear to be prepared for the new ESG reporting. Only just over 40 percent of Swiss companies will publish an ESG report in 2024. "It is particularly alarming that 10 percent of the companies that are now legally obliged to report will not publish a report this year," says Siyana Gurova from the Center for Global Competitiveness at the ZHAW School of Management and Law.

Although there is a general willingness to publish ESG reports, in practice, firms encounter challenges such as technical issues and a shortage of ESG specialists. While almost half of multinational companies have a dedicated ESG officer in their top management, less than 30 percent of small and medium-sized companies do. This discrepancy highlights how company size significantly influences compliance with ESG standards and reporting. Additionally, the willingness to adhere to these standards varies across language regions, with the French-speaking regions notably lagging behind.

Awareness among companies is increasing

Despite only a slight increase in the number of companies intending to report on ESG issues in 2024 - around three percentage points more than in 2023 - the survey shows that the importance of ESG activities has increased significantly over the last three years, particularly in relation to environmental issues. This increase shows a growing awareness that often triggers substantial organizational changes. In contrast, the social dimension of ESG, encompassing issues such as (gender) income equality, labor safety and supplier labor practices, have gained the least importance.

Different perceptions in the language regions

The perception of the financial impact of ESG activities on companies varies significantly between the language regions. Managers in Italian-speaking Switzerland perceive low or even negative returns from ESG investments, while their peers in French- and German-speaking regions report more optimistic results. Although top management is an important proponent of ESG initiatives, external factors such as regulatory requirements and consumer expectations play an even greater role. As a result, ESG data is predominantly used in product development and marketing, while HR departments are the least affected by ESG strategies.

Challenges and future directions

This year's survey shows that Swiss companies are making remarkable progress in their ESG efforts. However, they still face significant obstacles. "There is widespread awareness among top executives about the strategic value of ESG data. However, using this information effectively to drive business success remains an area that requires further cultivation," the study authors concluded.

Contact

Dr. Benedikt Zoller-Rydzek, Center for Global Competitiveness, ZHAW

School of Management and Law, Phone 058 934 46 90, E-Mail benedikt.zoller@zhaw.ch

Christian Busenhart, Kommunikation, ZHAW School of Management and Law, Phone 058 934 77 41, E-Mail christian.busenhart@zhaw.ch