The Digital World? Insurance Policy Holders Have Bigger Problems

Micro-businesses and small enterprises rate their insurers’ digital products as less relevant compared to solid advice and good insurance coverage. These are findings from the ZHAW Insurance Study 2023.

In Switzerland, over 500,000 companies belong to the segment of micro-businesses (one to nine employees) and small enterprises (10-49 employees). Insurance companies have identified this customer segment as a strategic target group for their business development. But what are the needs of this segment in terms of insurance products and ancillary services? That's what a recent study by the ZHAW School of Management and Law investigated. To obtain the data, 250 small enterprises and 1,189 micro-businesses from various industries were surveyed online in March 2023. Project partners included Zühlke Engineering AG and Synpulse Schweiz AG.

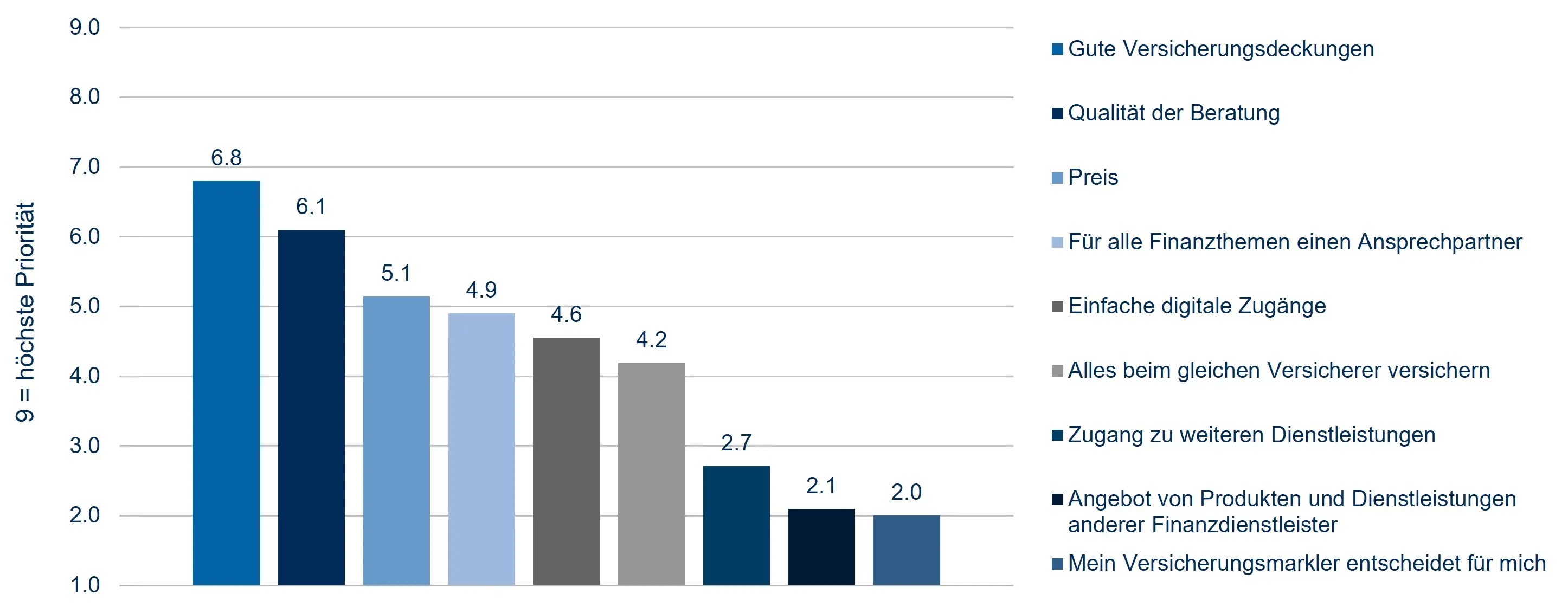

Digital Solutions Play a Subordinate Role

When buying insurance, two criteria are key: good insurance coverage and the quality of the advice provided. Interestingly, price comes a distant third, closely followed by the need to have a contact person for all financial issues and the possibility of simple digital access. Access to products from third-party providers or to additional services is not perceived as very relevant. "Service companies tend to rate the importance of digital access higher than companies in the manufacturing or agricultural sectors. On the other hand, the latter tend to appreciate the availability of a single contact person to deal with all financial topics," study leader Lukas Stricker from the Institute of Risk & Insurance at ZHAW said when he introduced the results. He added: "Therefore, a very targeted and demand-driven approach is needed."

Preferred Communication Channels

The low preference for simple digital access when buying insurance is also reflected in the preferred communication channels and contact persons during the contract period. More than 52 percent of respondents prefer their insurance advisor at the agency or call center as their primary contact. About 33 percent prefer their broker. Just under five percent go online via a portal or website. The communication channels of choice are still phone and email, as well as face-to-face meetings. Preferences for communication channels vary by industry.

Basically Satisfied – and Loyal

Most respondents expressed satisfaction with their existing insurance solutions, but not enthusiasm. Satisfaction with the insurance policies purchased is highest with regard to the two most important priorities, namely good coverage and good advice. "What is surprising, on the other hand, is that the non-digital approaches, which are nevertheless strongly preferred, are assessed slightly more critically than the less preferred digital approaches," according to Lukas Stricker, who assessed the results.

Contrary to the widespread opinion that customers see little difference between one insurance provider and the next, the survey revealed a very differentiated profile for each insurance company assessed: No insurer came out on top in all criteria. Instead, company profiles emerged, for example, insurers with good prices but poor advice and few additional services – or vice versa. Then again, there are those with a medium profile along most of the criteria. The differences in the assessments are considerable. Only on the question of insurance coverage does the differentiation seem to be limited, at least at the bottom end. "Insurers that fell below the threshold of 'rather satisfied' for this important criterion would probably no longer be marketable," Lukas Stricker stated. Surprising, however, were the significant differences in the assessment of the various insurers with regard to non-digital access and the quality of advice. There is considerable potential for differentiation here.

The study also showed: Policy holders are generally loyal and stay with their insurance companies in most cases. "There is only a limited willingness to switch, with this being highest in the first few years after taking out the policy," Lukas Stricker concluded. A more comprehensive report, which will also include the results of the expert interviews with the insurers, will be published in the fall of 2023.

Contact

Lukas Stricker, Institute of Risk & Insurance, ZHAW School of Management and Law, phone: +41 58 934 74 62, email: lukas.stricker@zhaw.ch

Valerie Hosp, Communications, ZHAW School of Management and Law, phone: +41 58 934 40 68, email: valerie.hosp@zhaw.ch